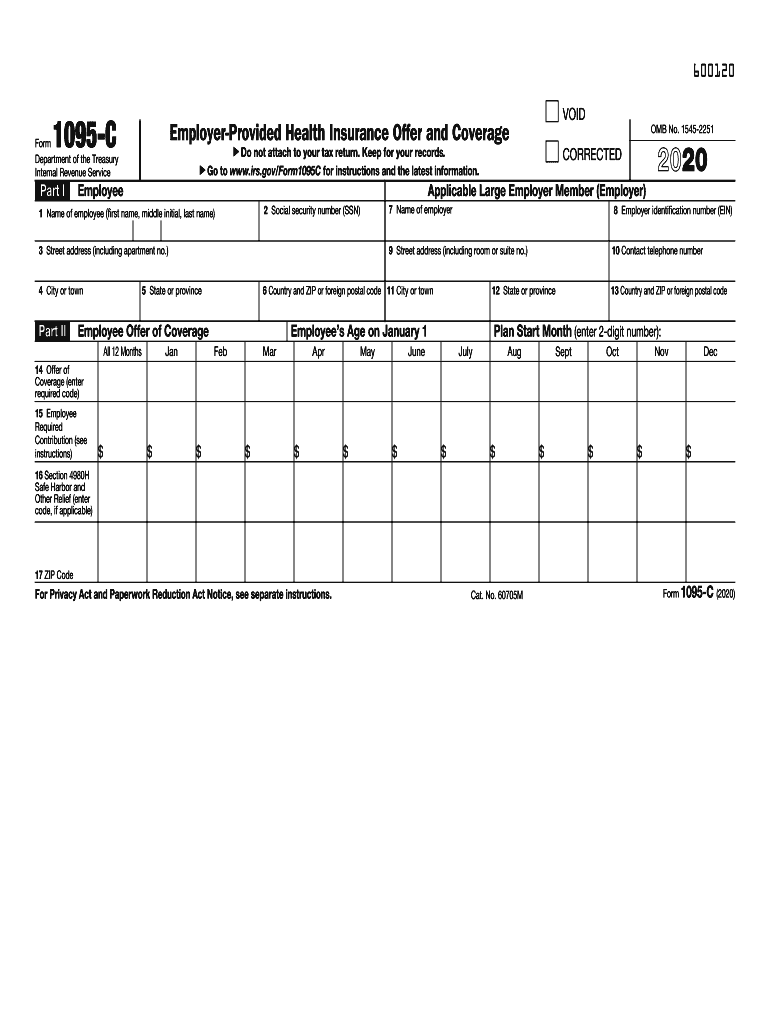

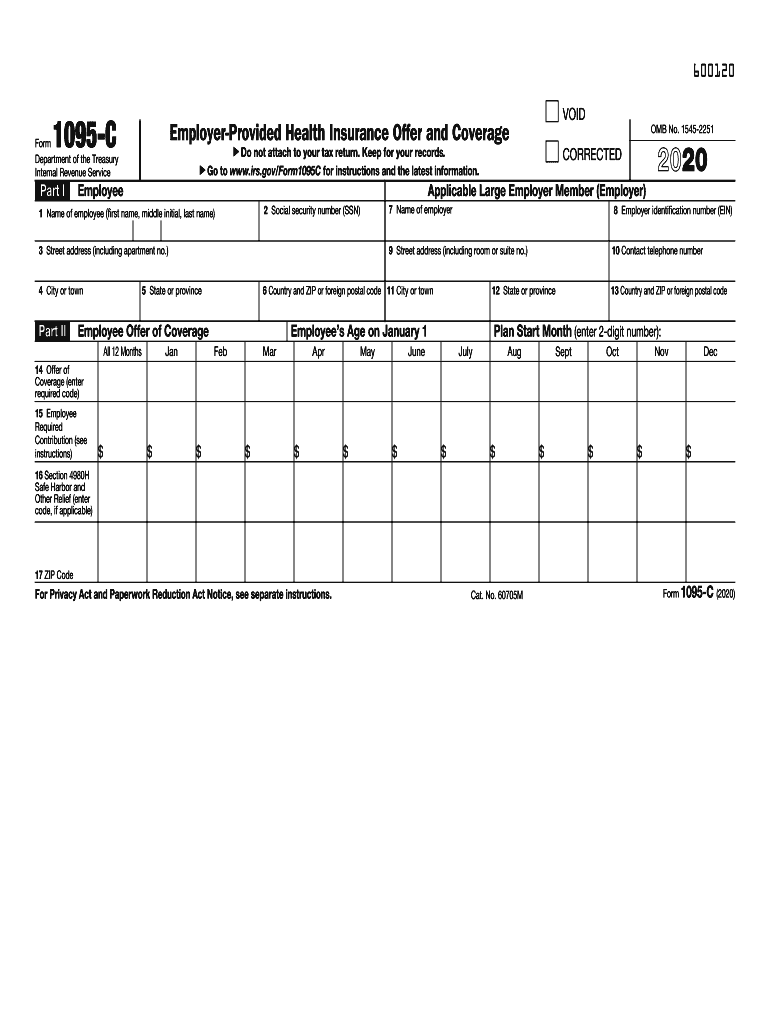

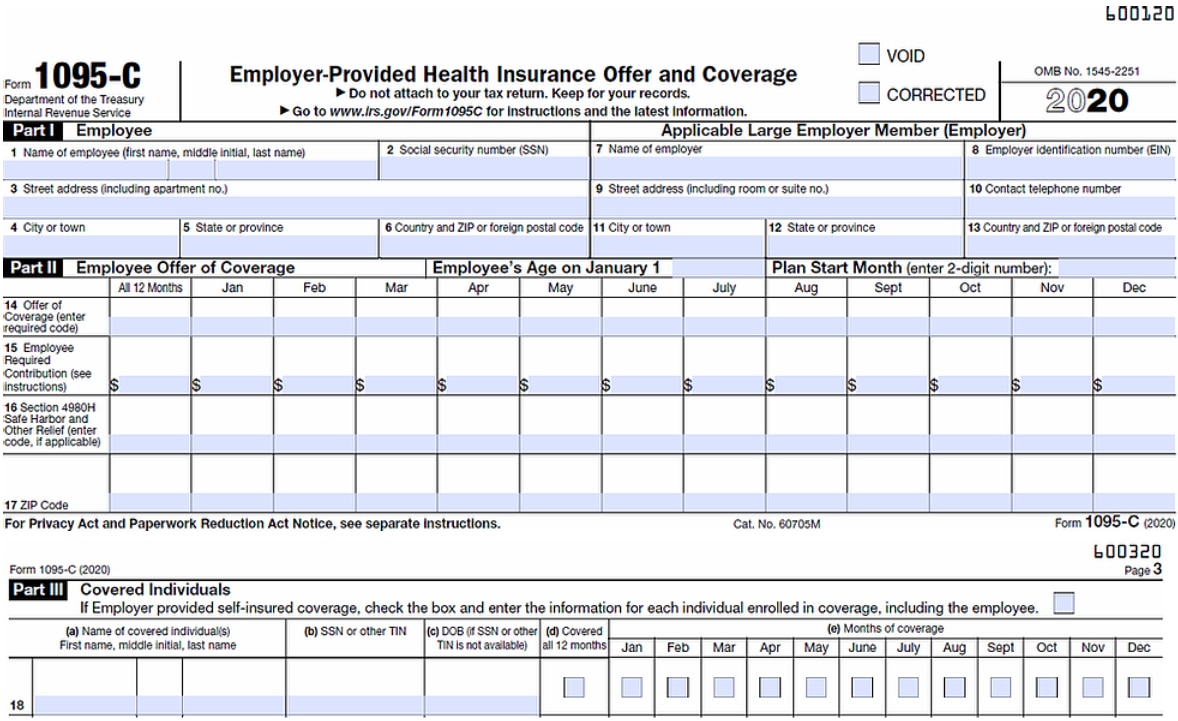

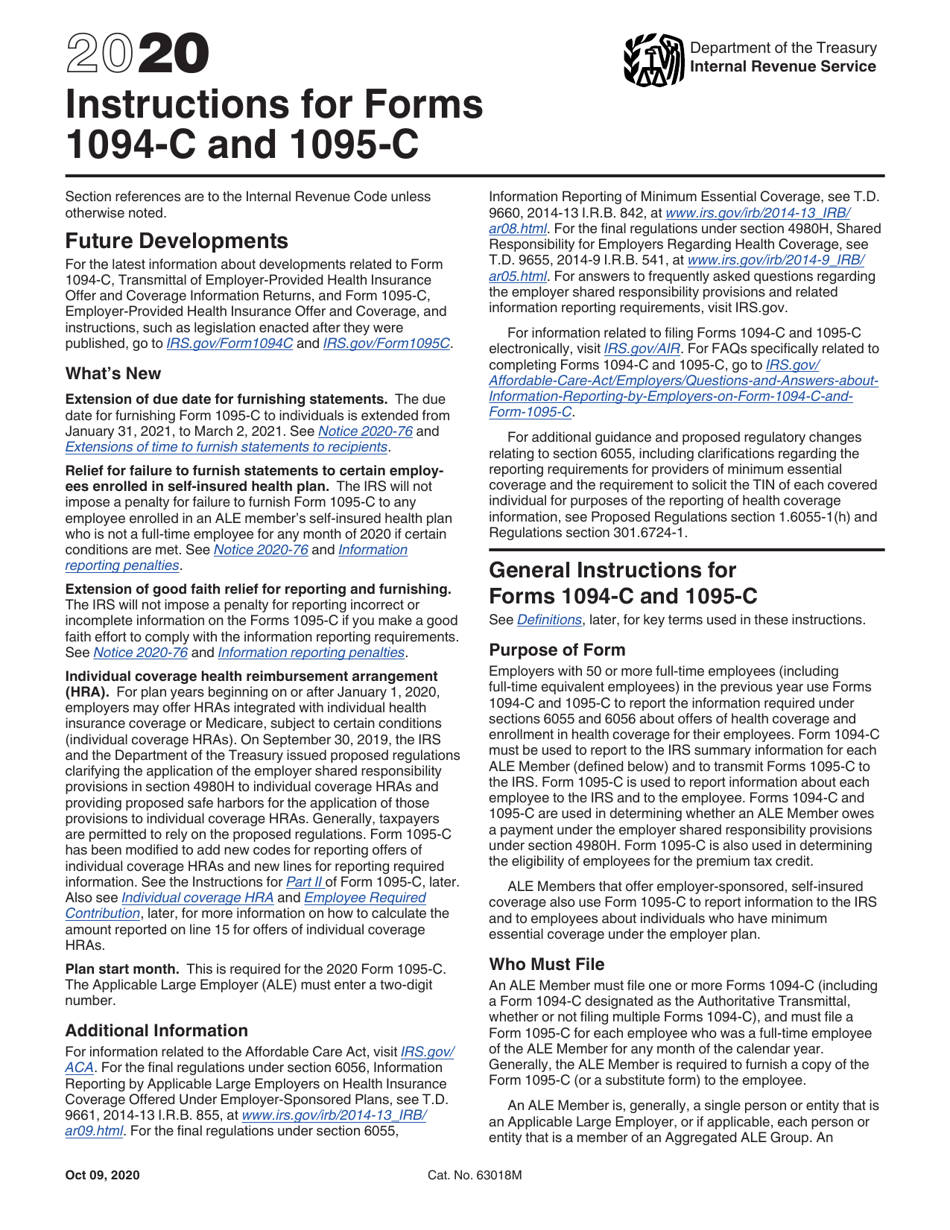

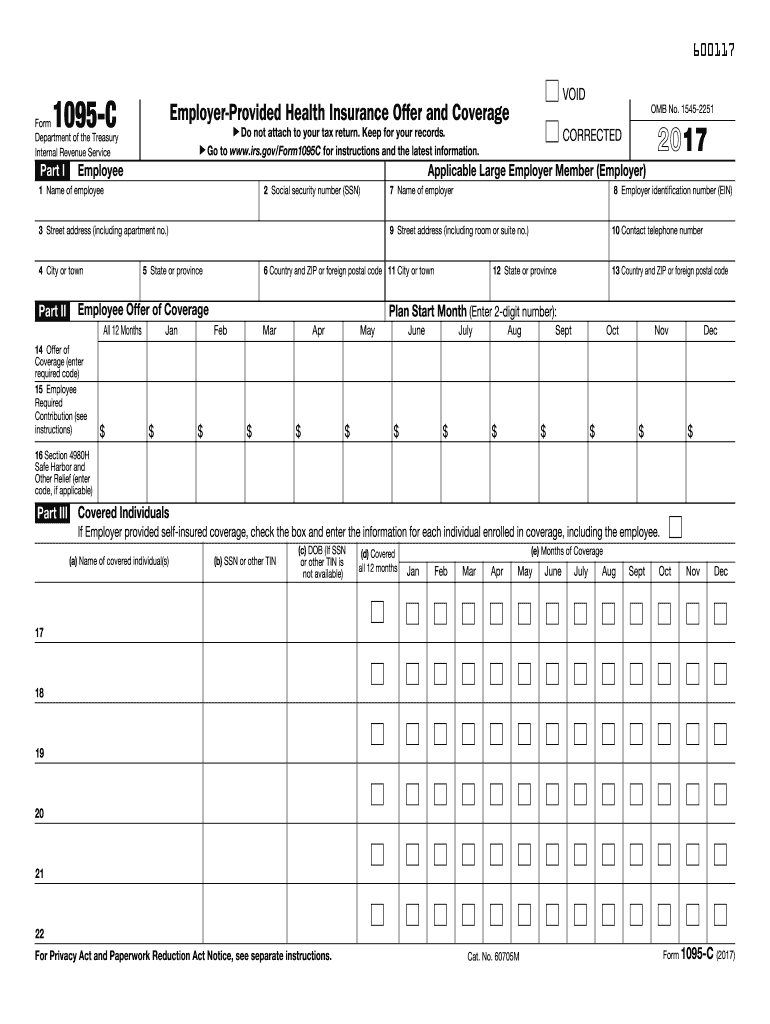

In late February, the university will be mailing a tax form called the 1095C to faculty and staff, who may need this form when filing taxes for The form documents eligibility and/or enrollment in the JHU medical plans for This same information will be reported to the IRS The form is not required to be attached to the form 1040Forms 1095B and 1095C are not required to compute your federal tax liability nor needed to file an income tax return with the IRSForm 1095C EmployerProvided Health Insurance Offer and Coverage is a tax form reporting information about an employee's health coverage offered by

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

1095-c form for filing taxes

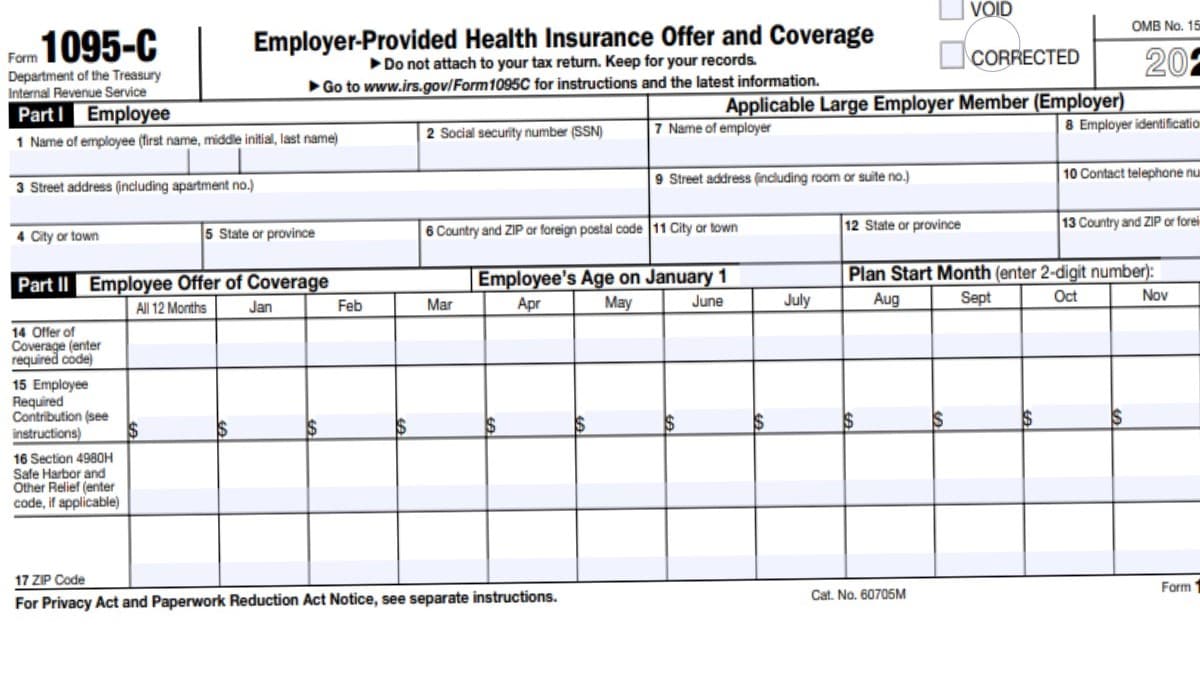

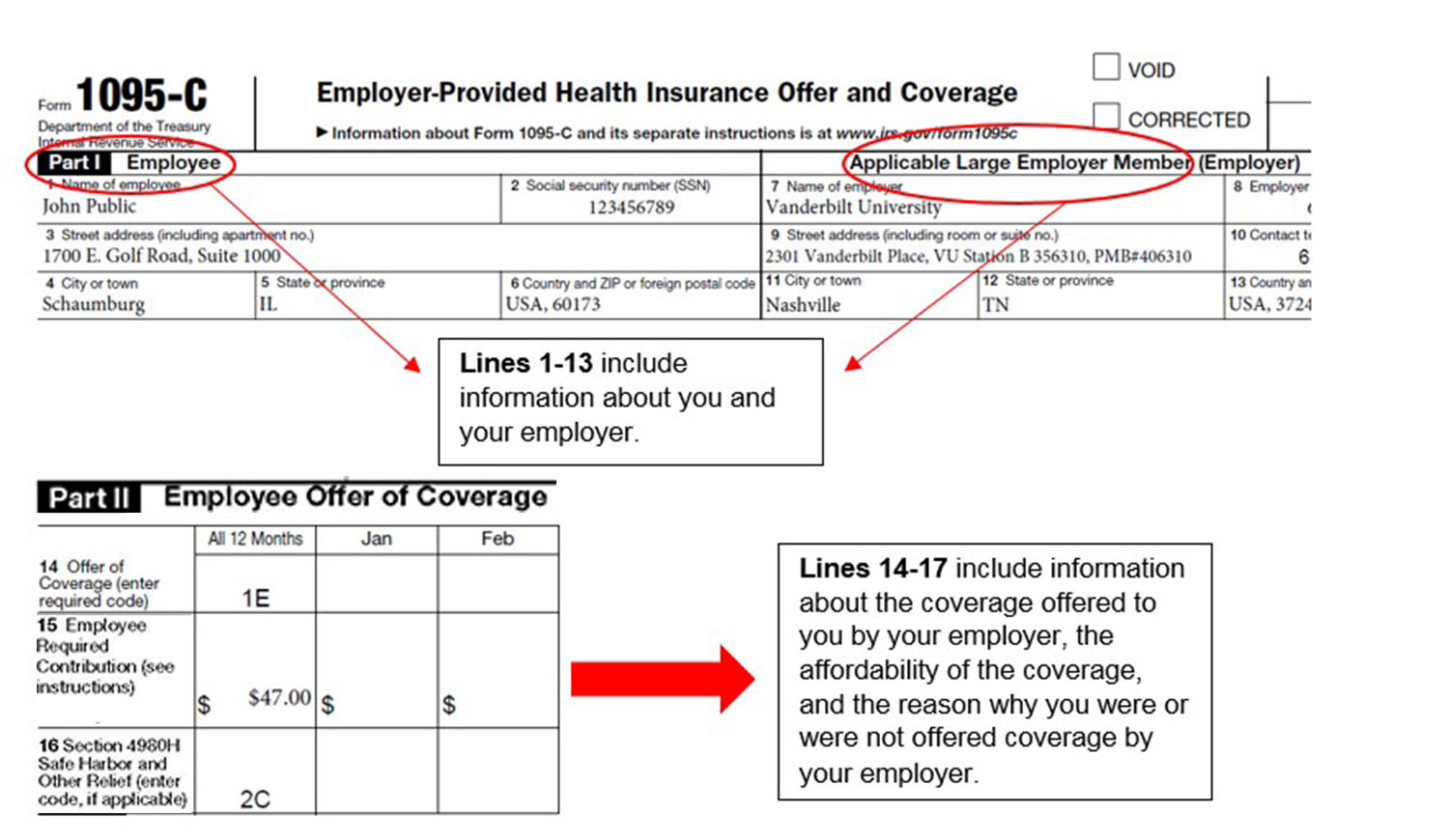

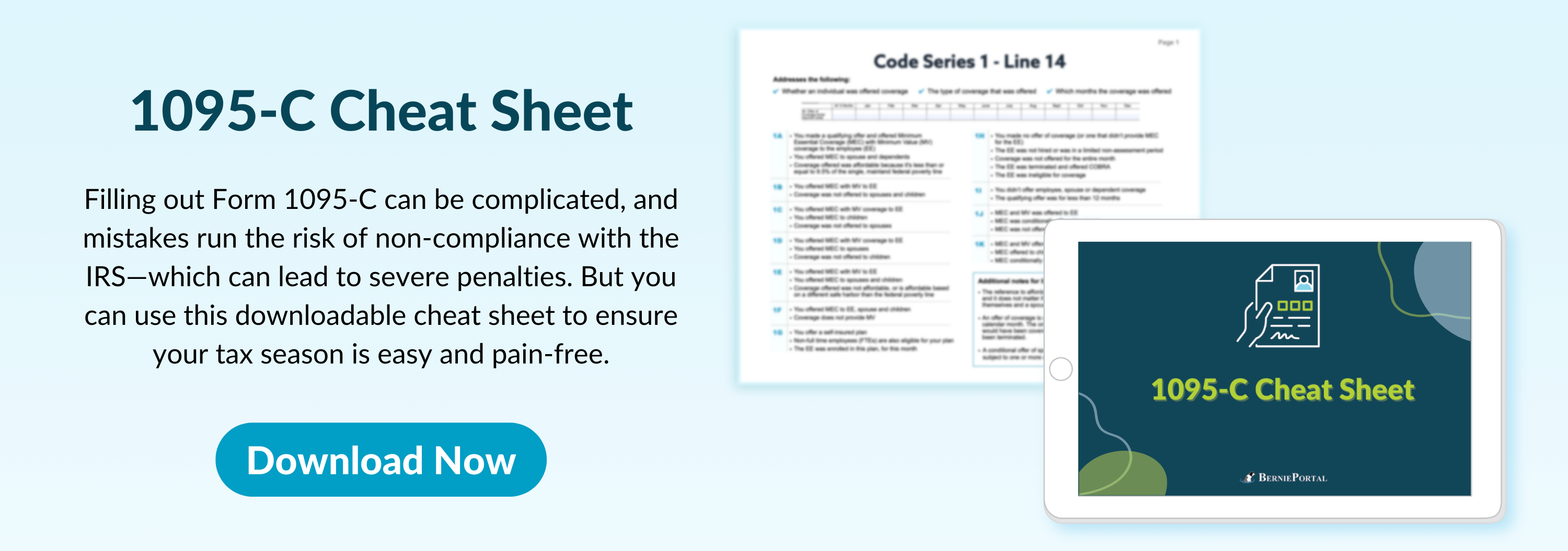

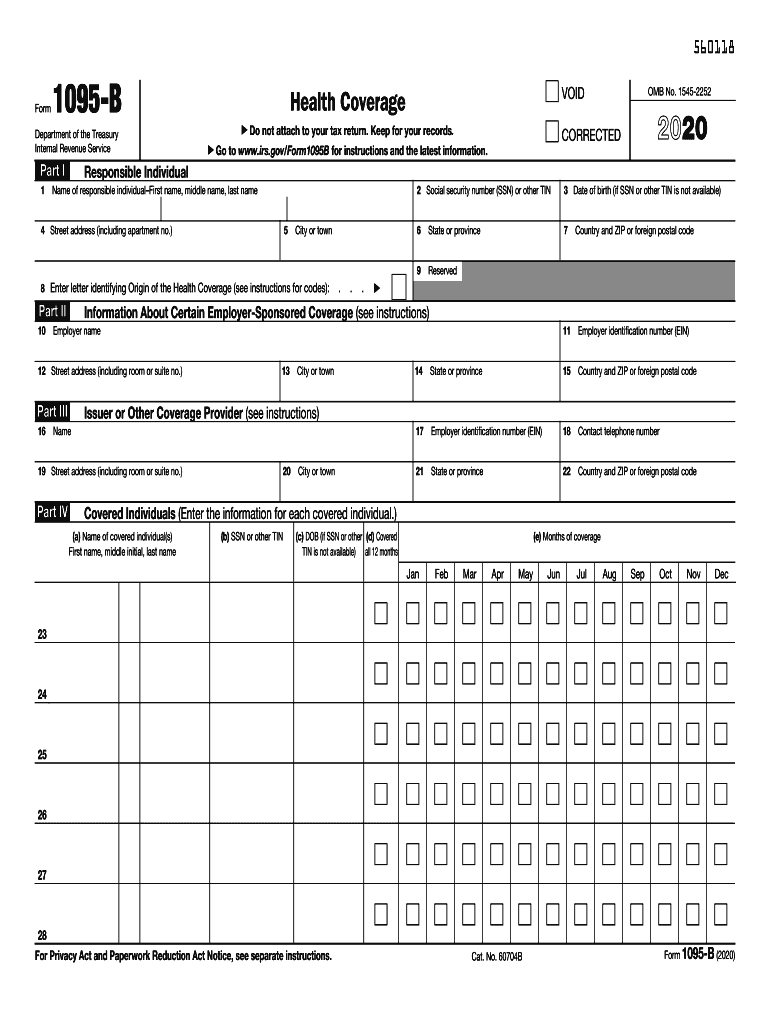

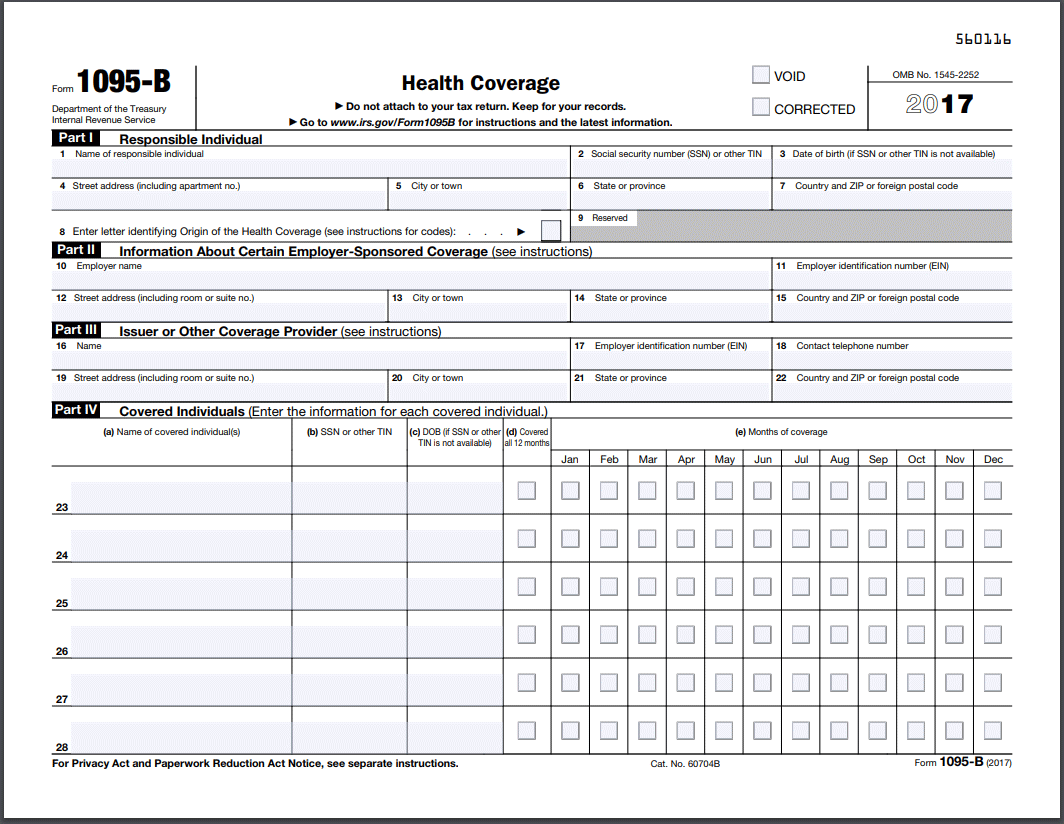

1095-c form for filing taxes- The IRS can also identify which ALEs have not filed or furnished their information returns, resulting in penalties under IRC Sections 6721/6722 When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by the

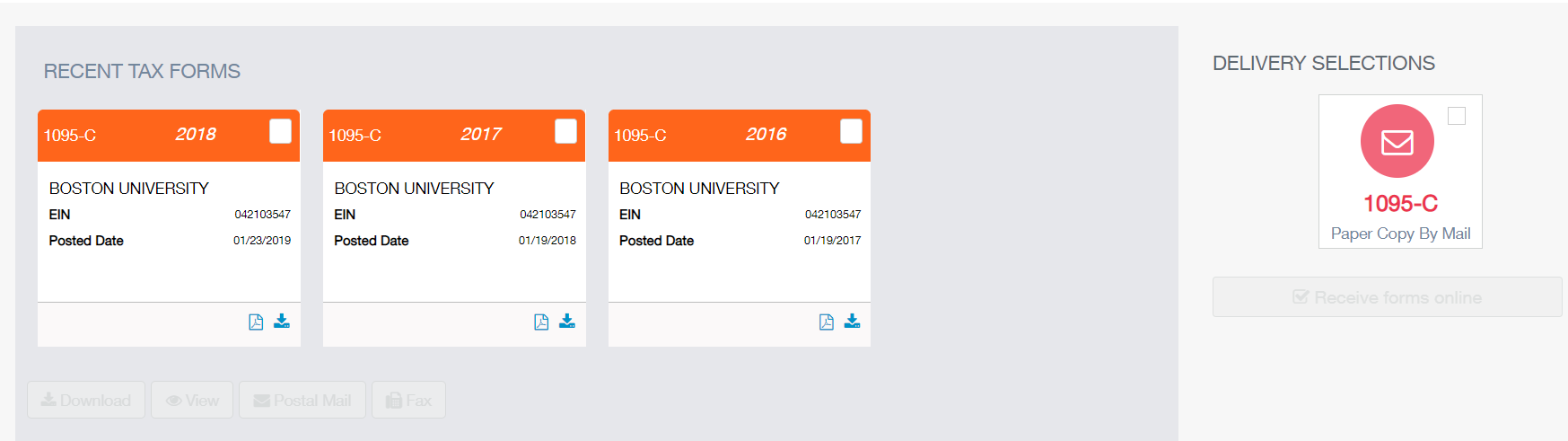

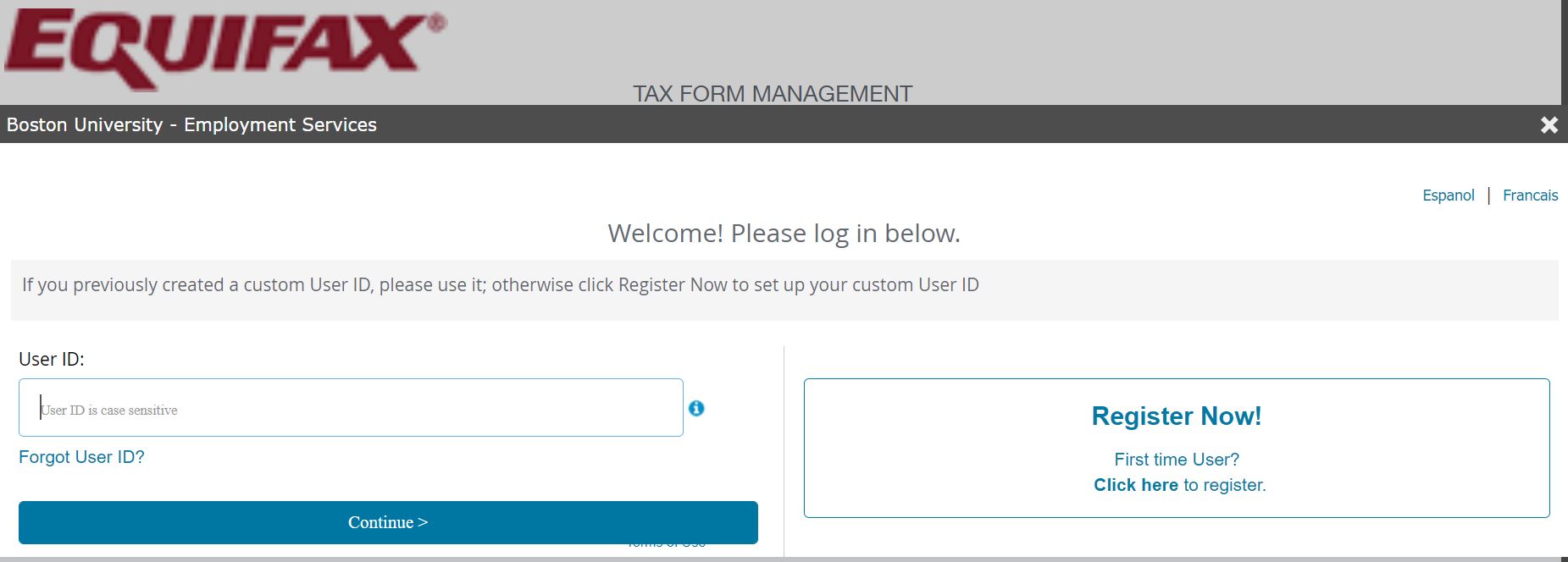

Www Gvsu Edu Cms4 Asset 80c1f353 95b0 5ce8 A6be76c71e24ea8a Electronic W 2 1095 C Forms Instructions Pdf

All How will I receive a copy of my 1095B or 1095C form?Form 1095C's for the University of Pittsburgh employees for the 18 tax year are to be mailed in January 19 If you believe you should have received a Form 1095C but did not, please contact the University of Pittsburgh's Benefits Department at hrbenque@pittedu Form 1095C provides information about the health coverage offered by your employer and, in some cases, about whether you enrolled in this coverage Use Form 1095C to help determine your eligibility for the premium tax credit

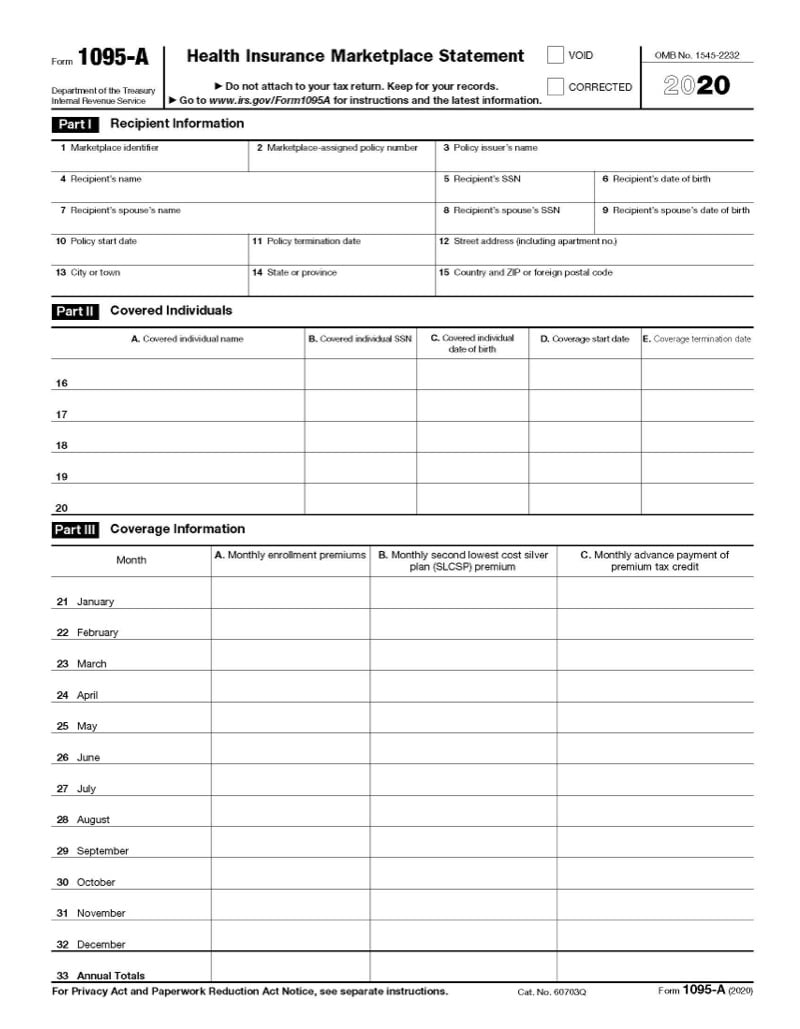

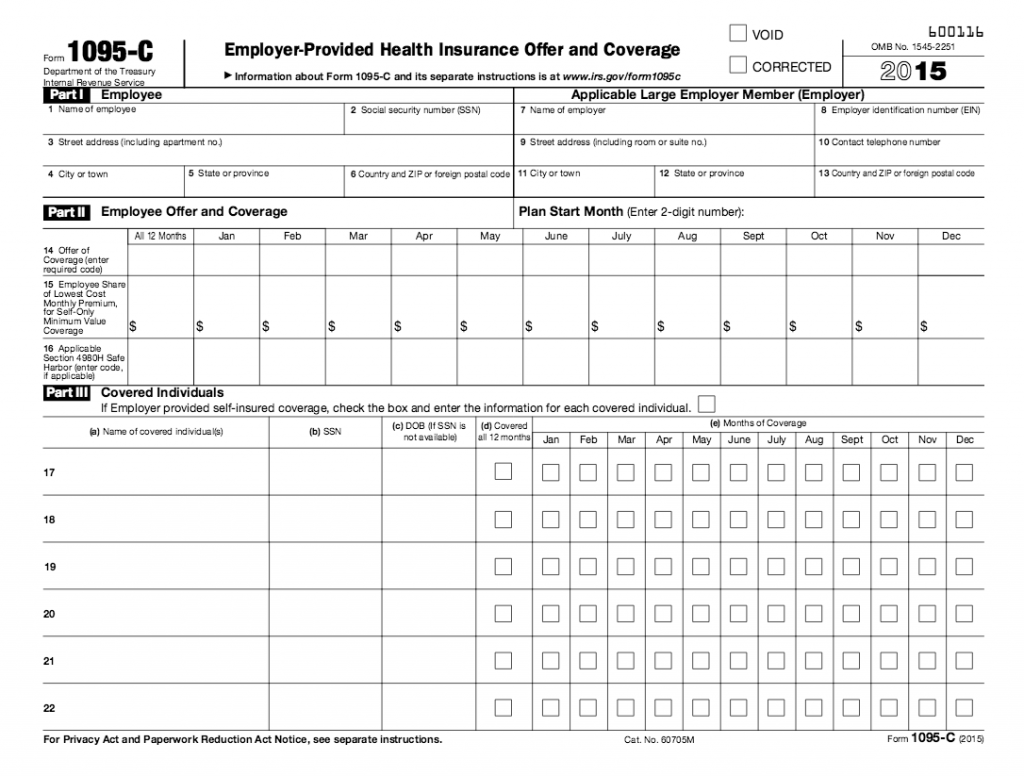

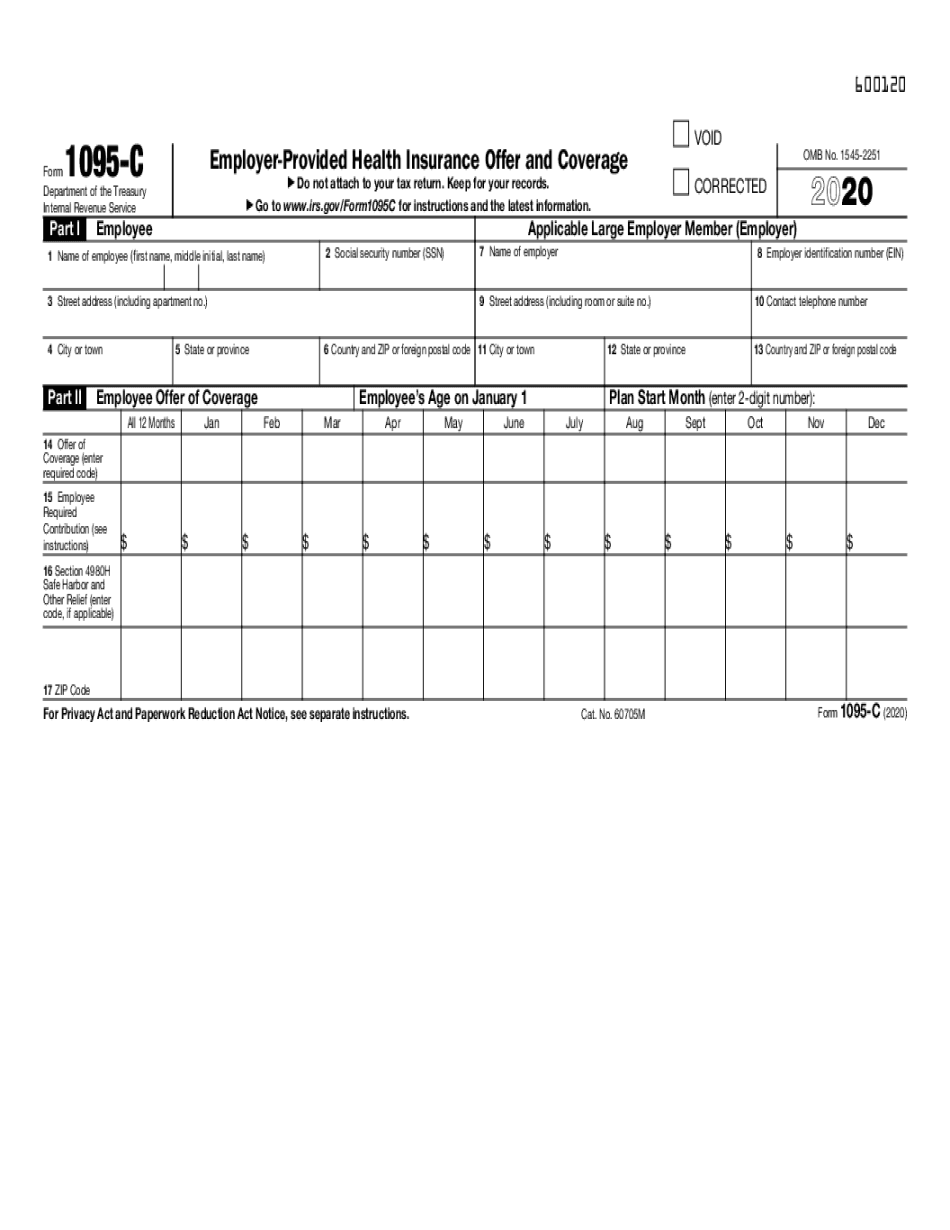

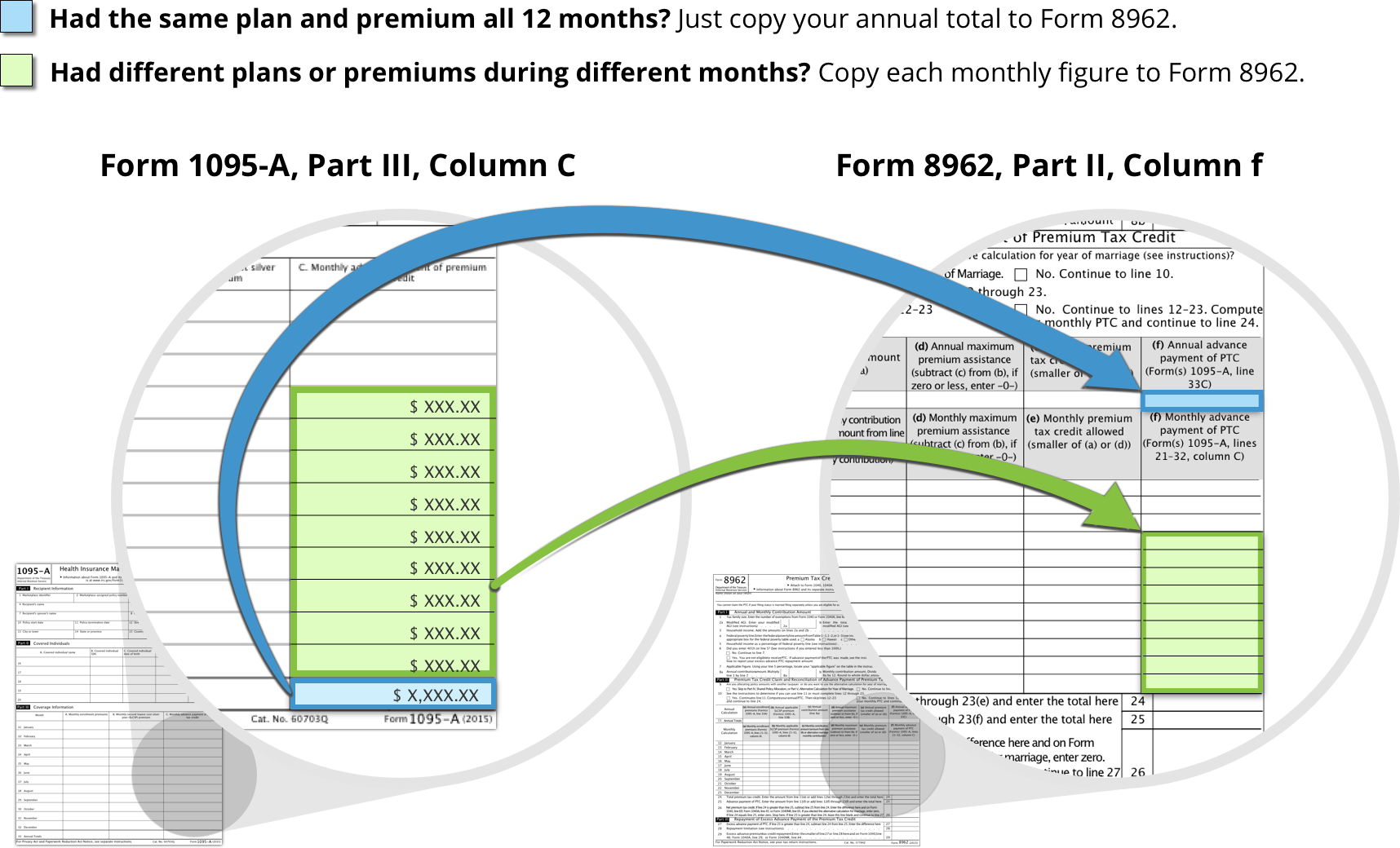

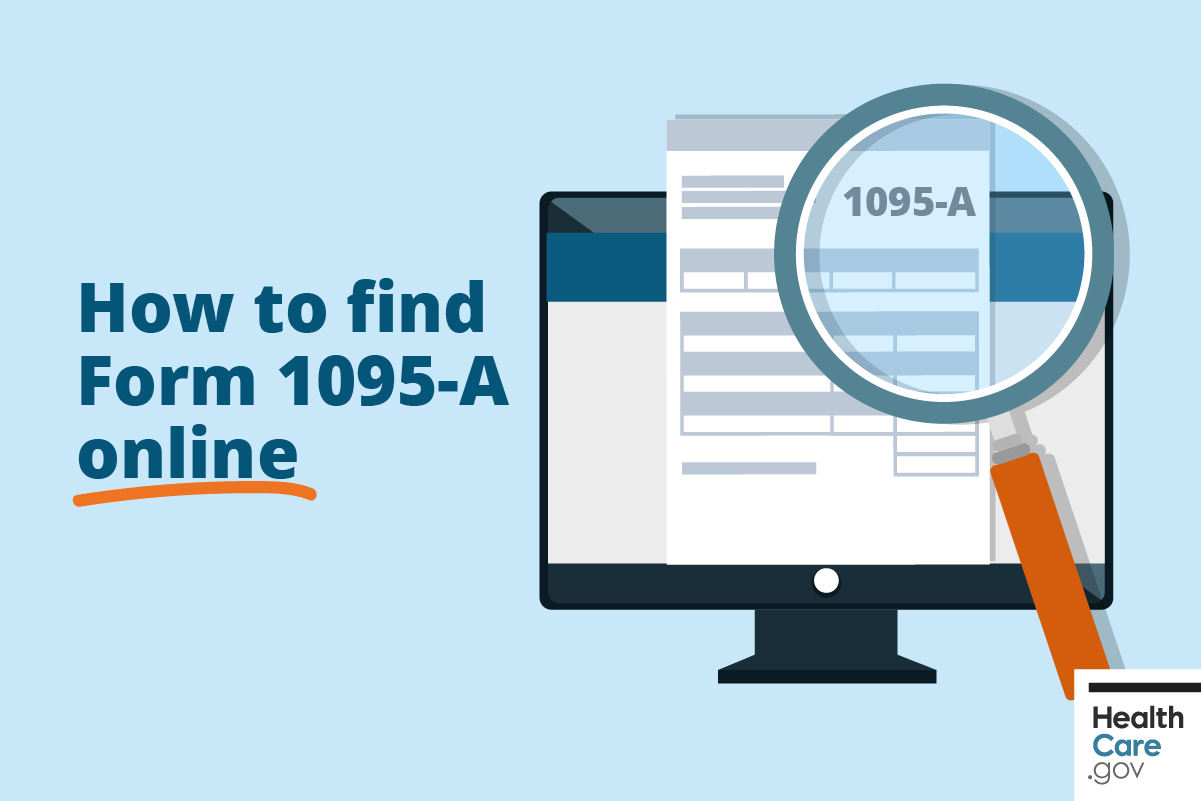

1095C Form Information This new 1095C Form, related to the Affordable Care Act (ACA), is a certificate of EmployerProvided Health Insurance Offer and Coverage Beginning with tax year 15, this form is required by all large employers to report offers of health coverage and enrollment in health coverageIMPORTANT You must have your 1095A before you file Don't file your taxes until you have an accurate 1095A Your 1095A includes information about Marketplace plans anyone in your household had in It comes from the Marketplace, not the IRS Keep your 1095As with your important tax information, like W2 forms and other recordsThe Internal Revenue Service (IRS) issued draft form 1095C that employers will use to report health coverage they offer to their employees as required by the Affordable Care Act (ACA) The form is for the 18 tax year (for filing in early 19) On the 18 Form 1095C the "plan start month" box will remain optional

There is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21 1095C and Premium Tax Credit (PTC) Eligibility?Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

About Form 1095C In late February 21, the Health Care Authority, on behalf of your employer or former employer, will mail Forms 1095C and an explanatory insert to Employee, retiree, and continuation coverage subscribers of state agencies, commodity commissions, or higher education institutions enrolled in Uniform Medical Plan for at least one month in 19 Form 1095C, employerprovided health insurance offer and coverage, shows the coverage that is offered to you by your employer It is used by larger companies with 50 or more fulltime or fulltime equivalent employees This form provides information of the coverage your employer offered and whether or not you chose to participateForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

IRS Form 1095C is one of the Affordable Care Act Forms offered by Tax1099 The form is for reporting information to the IRS and to taxpayers about individuals not covered by minimum essential healthcare coverage The health care law defines that employers must offer health insurance to their workersForm 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage Where do I add a 1095C form?

1

2

Your 1095C Tax Form Similar to last year, you will be receiving a 1095C form per the Affordable Care Act This form provides verification that you and your dependents had coverage in You will not be required to file this with your tax returns but you will need to retain the form in your records For team members who were enrolled inWell, this is mostly just for your information If your employer provides EmployerSponsored Affordable Health Coverage, then you are not eligible for the Premium Tax Credit So, if you have been covered by your employer, this will make the 1095C, not at all important when calculating anythingYou do not have to enter a 1095C in TurboTax You will answer the question in the Health Insurance section that you had health insurance all year and keep a copy of the 1095C with your tax records The insurance company will provide the IRS with the needed information

Form 1095 C H R Block

Understanding Irs Forms 1095 A 1095 B And 1095 C

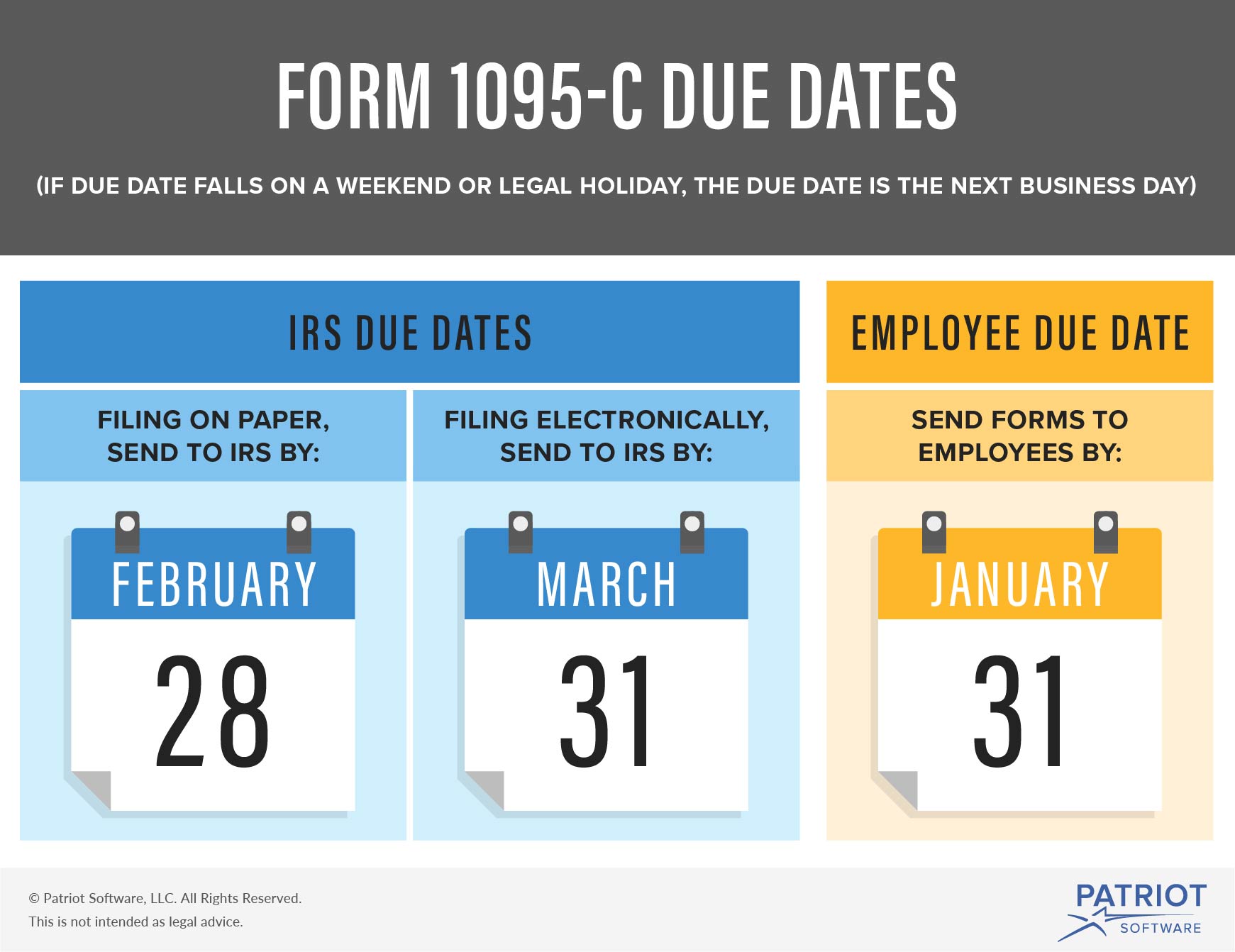

Form 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxActEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsEmployers are responsible for furnishing their employees with a Form 1095C by Thursday, Employers are still responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper or Monday, , if filing electronically (same as Form 1094C)

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files How to read your 1095 C Pdf

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting documentWhile not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W2 wageThe information below is for Tax Year 19 Learn more about the 1095C for Tax Year In the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in 19 While you will not need to include your 1095C with your 19 tax return, or send it to the IRS, you may use information from your 1095

1

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

1095C I think I'm getting fined I have Covered California from July to Dec (1095A Form), my previous employer sent me 1095C for Jan to May but there is no where I can enter on Turbo Tax I heard if you don't have health insurance for 3 months you are finedEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsThis form will be sent to you separately from other tax documents such as the W2 or 1099R The 1095C indicates which months during the year you and, if applicable, your dependents were enrolled in state sponsored medical and prescription plans You do NOT have to attach Form 1095C with your submitted federal income tax return

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Coming Soon Irs Form 1095 For 19 Ucpath

Form 1095C is a required tax document under the Affordable Care Act (ACA) It contains detailed information about the medical coverage offered to you and your dependents by Miami University You will need the information from Form 1095C as part of your federal tax return The IRS will use this information, in part, to validate your compliance Edited If you have a 1095C, a form titled EmployerProvided Health Insurance Offer and Coverage the IRS does NOT need any details from this form You can keep any 1095C forms you get from your employer for your records When you come to the question "Did you have health insurance coverage in 15", simply select "Yes"About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue

2

What The Heck Is Form 1095 C

There are other IRS tax forms that are similar to Form 1095C that you may request IRS Form 1095B details the months of health insurance coverage that you, your spouse and/or any eligible dependents had for each monthForm 1095C is used by the IRS to determine if the employer owes a payment under the employer shared responsibility provisions under section 4980H It is also used to determine if an employee is eligible for premium tax credit Form 1094C is a summary form that is filed with form 1095C electronically or on paper With the passing of the Affordable Care Act, three new tax forms came into the scene Form 1095 A, B, and C These tax forms were used to report your healthcare coverage during a tax year But, in 19, the healthcare penalty went away

Understanding Your Form 1095 A Youtube

Tax Form 1095 A Frequently Asked Questions

Duke Human Resources will send the 1095C form to the home addresses of faculty and staff no later than March 4 The IRS does not require individuals to mail in the form with their annual income tax return, but you should retain the 1095C form with your other important tax records Form 1095C is not required to file your tax return Mon, In late February 21, the Health Care Authority (on behalf of your employer) will mail Forms 1095C to state agency, highereducation, and commodity commission employees enrolled in Uniform Medical Plan (UMP) Employees determined "fulltime" under Affordable The 1095 tax form appeared on the scene after the Affordable Care Act passed It helps ensure taxpayers, employers and insurers comply with certain provisions of the act The form includes important information about a taxpayer's health insurance coverage — most people will get at least one of three versions of Form 1095

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverageThe IRS Form 1095C is a form that reports to the IRS if you had the minimum essential coverage required under the ACA and also which months of the year you had the qualified coverage Why is it so important to prove I had minimum essential coverage?The Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRS

What Does A 1095 C Delay Mean For 1040 Filings Integrity Data

1095 C Faqs Mass Gov

Hr Updates Theu

2

Your 1095 C Tax Form For Human Resources

Employeeservices Sccgov Org Sites G Files Exjcpb531 Files Documents 1095 C Attachment Faq Pdf

Www Talgov Com Uploads Public Documents Retirement 1095 Faq Pdf

Affordable Care Act Aca Forms Mailed News Illinois State

Www Bgsu Edu Content Dam Bgsu Human Resources Documents Benefits Compliance All About The 1095 C Pdf

2

Hr Princeton Edu Document 3006

Info Nystateofhealth Ny Gov Sites Default Files English aptc cover letter Pdf

Www Health Ny Gov Health Care Medicaid Publications Docs Gis 15ma0 1095bcover Pdf

What Are 1095 Tax Forms For Health Care 1095 A 1095 B 1095 C Youtube

1095 A Tax Form H R Block

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Www Fscj Edu Docs Default Source Hr Communications Irs Form 1095 C Faqs Pdf Sfvrsn 2

Understanding Form 1095 C And What To Do About Errors The Aca Times

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

2

Louisville Edu Hr Benefits Form 1095 C Faqs

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 C Form 21 Finance Zrivo

A Guide To Forms 1095 1098 And Nonresident Tax Returns

Your 1095 C Tax Form For Human Resources

2

Updates To Form 1095 C For Filing In 21 Youtube

/arc-anglerfish-arc2-prod-mco.s3.amazonaws.com/public/OBNPTJ3ZI5H45PGFNVWFGNBQGE.jpg)

Important Tax Document To Watch For

Files Nc Gov Ncosc Documents Training Job Aids Benefits Ben 1 1095 C Faqs A Pdf

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

What You Need To Know About Forms 1094 1095

1095 C Form 18 Best Of Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

Www Ddouglas K12 Or Us Wp Content Uploads 17 11 From 1095 Faq 17 Pdf

Obamacare Tax Forms 1095 B And 1095 C 101 Personal Finance Fredericksburg Com

2

Form 1095 C Forms Human Resources Vanderbilt University

1

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Ess Mo Gov Admin Attachmentviewer Id 168

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Www Irs Gov Pub Irs Pdf F1095b Pdf

Www Cgesd Org Cms Lib Az Centricity Domain 42 Memo to employees re 1095c forms and faqs Pdf

Www Cps Edu Globalassets Cps Pages Staff Former Employees Payroll Form1095 C Faq Pdf

Www Opm Gov Healthcare Insurance Fastfacts Health Coverage Forms Fast Facts Employees Pdf

Www Mymontebenefits Com Pdf Irs 1095 C Faqs

2

Info Nystateofhealth Ny Gov Sites Default Files Aptc cover letter 15 Pdf

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Hr Jhu Edu Wp Content Uploads 19 06 Aca 1095faq Pdf

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Community Pepperdine Edu Hr Content 1095 C Frequently Asked Questions Pdf

Www Gvsu Edu Cms4 Asset 80c1f353 95b0 5ce8 A6be76c71e24ea8a Electronic W 2 1095 C Forms Instructions Pdf

How To Reconcile Your Premium Tax Credit Healthcare Gov

Sonomacounty Ca Gov Workarea Downloadasset Aspx Id

1

Www Umassp Edu Sites Default Files Documents Human Resources 1095 C faq Pdf

Amazon Ehr Com Ess Client Documents Benefitsummaries 1095 C faqs updated 1 16 17 Pdf

Www Umassmed Edu Globalassets Human Resources Documents Benefits Final 1095 C Faq 12 16 15 Pdf

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Http Hr Fhda Edu Downloads Aca faq 2 Pdf

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Instructions For Forms 1095 C Taxbandits Youtube

Irs Form 1095 Form Ftb 35 And Your Health Insurance Subsidy

1095 C Form 18 Lovely Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

Irs 1095 B 21 Fill Out Tax Template Online Us Legal Forms

2

Your 1095 C Obligations Explained

Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Www Utdallas Edu Hr Download Irs Form 1095 C Faq Pdf

Www2 Illinois Gov Cms Benefits Stateemployee Documents 1095 Faqs Pdf

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Your 1095 C Obligations Explained

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Www Emich Edu Hr Documents Benefits Aca1095c Faq Pdf

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Mn Gov Mmb Assets 1095 Faq Jan4 17 Tcm1059 Pdf

Employees Will Soon Receive Tax Forms W 2 1095 C And 1042 S News Illinois State

It S Tax Time Be On The Lookout For Your W 2 And 1095 Forms

Your Obamacare Tax Form May Have Errors Here S Help Kqed

0 件のコメント:

コメントを投稿